Q: How did your family and culture influence who you are today?

I am very proud of my Mexican American heritage with Southern California roots. My husband, Craig Echeveste, and I raised our family here in Phoenix. My grandmothers (one who traveled from Guanajuato, Mexico in the 1900s and the other born and raised in Globe/Miami, Arizona) faced adversity and barriers, yet each worked tirelessly with strong faith to raise their families. My parents and other family members faced inequities and discrimination, yet built strong families with a strong bond of love for each other and our heritage – our arts, literature, music and serving our community. My family is central to my “why”. I am always striving to provide opportunities and access for others, especially those who have experiences similar to my parents and grandparents.

Q: Why is ACEE important to you?

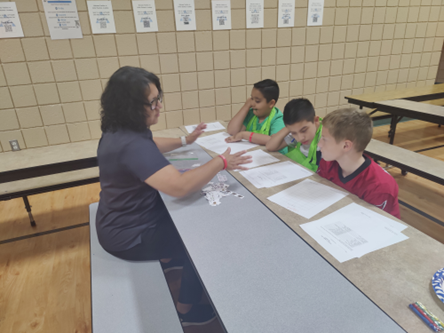

I started working with ACEE late in the 1990s as they expanded in Arizona. They have always been open to listening to educators, parents and financial partners about their approach to delivering their programs. They provide various ways to involve our employees in volunteering with students, teaching life skills and financial concepts. Empowerment and possessing a understanding of who they are serving – our students, their families, and teachers -has always been the heart of ACEE. They help our communities gain the knowledge they need to make confident, informed financial decisions and build their preferred future.

Q: Why do you care about financial and economic education?

Closing the Wealth Gap through Financial Literacy

As the world navigates an ever-changing economic landscape, Hispanic-Latinos and other communities of color face disproportionate negative financial impacts. Research from McKinsey found that Latinos have only a fifth of the median wealth of their non-Latino White counterparts, and half have little or no retirement savings.

Hispanic-Latino prosperity depends on ensuring individuals and families have access to the resources and guidance they need to navigate challenging times, prepare for the future and reach their financial goals. Bank of America’s investment in ACEE expands access to financial literacy education and advice which then empowers teachers and parents to teach children about finance and economics.

Many in our community are taking advantage of free, bilingual tools that make financial wellness more accessible like Better Money Habits / Mejores Hábitos Financieros, which offers online tools and resources to help deliver practical, easy-to-understand knowledge about managing finances in both English and Spanish.